HARDWOOD REVIEW... SPECIES OF THE DECADE

HARD MAPLE AND CHERRY PRICES INCREASES IN THE 90'S HAVE

BEEN AMAZING

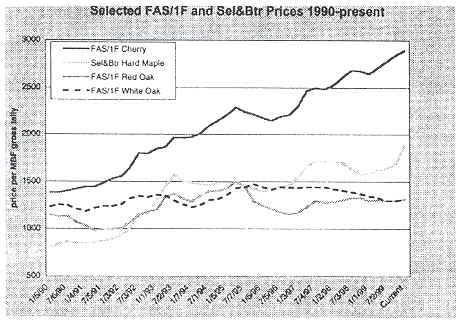

Looking back, few realize that just 10 years ago Southern 4/4 kiln dried Red Oak prices

were higher than those for Hard Maple. To be exact the average price paid for Southern 4/4

FAS/1 F Red Oak was $350 higher than Northern 4/4 Sel/Btr Hard Maple KD whereas today the

Hard Maple averages $580 higher than the Red Oak. The same relationships hold true for the

common grades, where the Red Oak has moved from +$ 110 to -$460 for the #1 and from +$50

to-$60 for the #2 Common.

Lumbermen may indeed look back at the 90's as the decade of Hard Maple. They most

certainly will look back on the 90's as the decade of constantly increasing log prices

that, despite record lumber price increases, have threatened profitability for the same

10-year period.

Hard Maple use has expanded around the world, but there is not any more Hard Maple

being grown today than 10 years ago. The result of an expanding number of markets chasing

a limited supply is easily illustrated when one looks at the use of Hard Maple. In the

late 80's it was not unusual for a kitchen cabinet manufacturer to produce 80% or more of

their cabinets from Red Oak. Today, the situation is much different as the consumer

preference for Hard Maple and Cherry alongside an extended economic upswing where housing

has been quite strong has created cabinetry markets that seemingly set records every

quarter. While Red Oak is still a major part of the production mix, this change in

consumer preference is very evident when one looks at new construction and remodeling

activity.

Much the some holds true in furniture. Back is the modern 70's look of naturally

finished Hard Maple, Beech, Hickory and Cherry, combined with the use of glass and metal.

But in an industry that also suffers from low margins, the extreme upward swings in lumber

prices have frustrated many manufacturers, with them often venting their frustrations at

lumber producers. The real culprit has been that a large number of users have been chasing

a limited, scarce resource, which has escalated log prices significantly over the last 10

years.

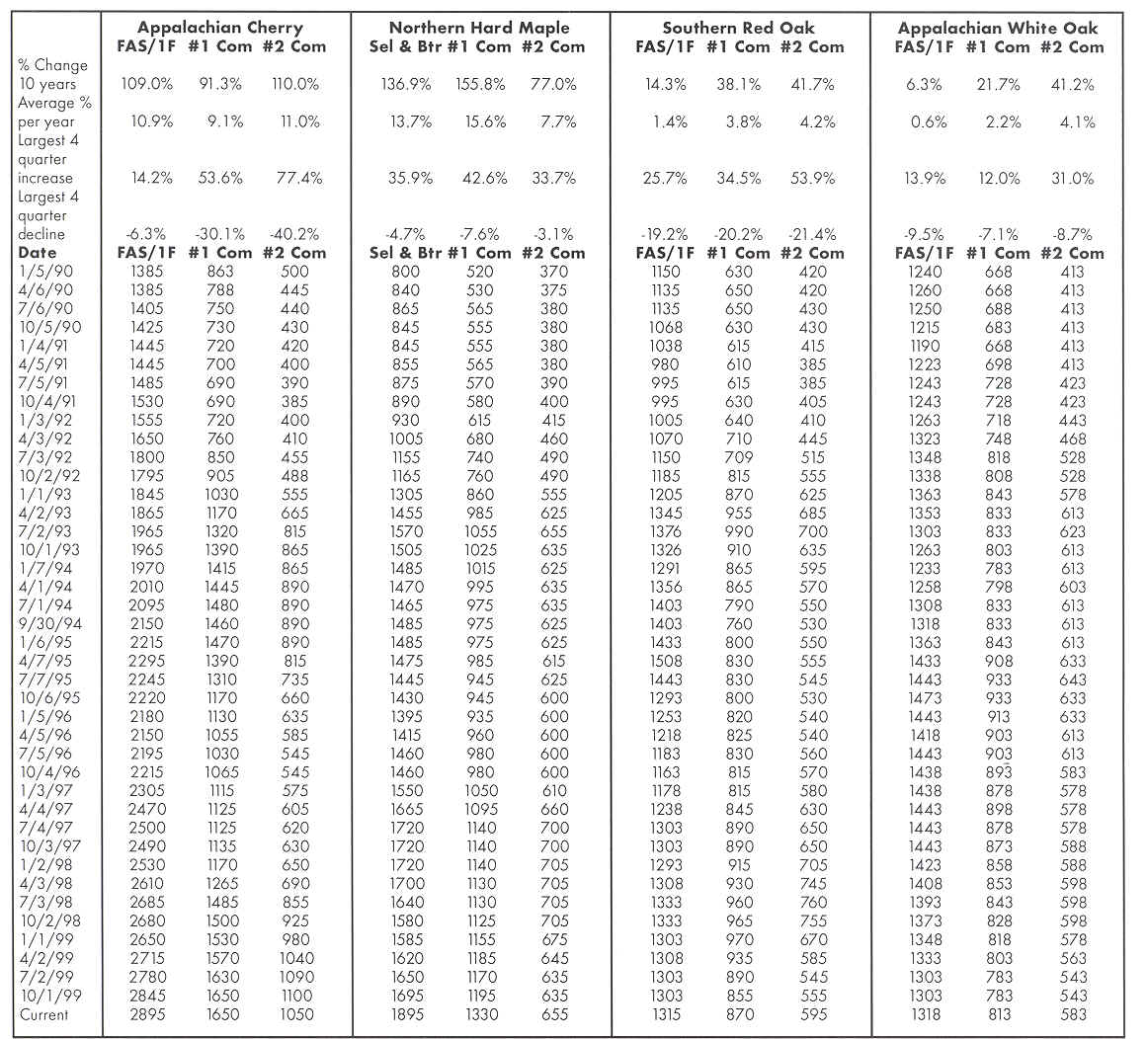

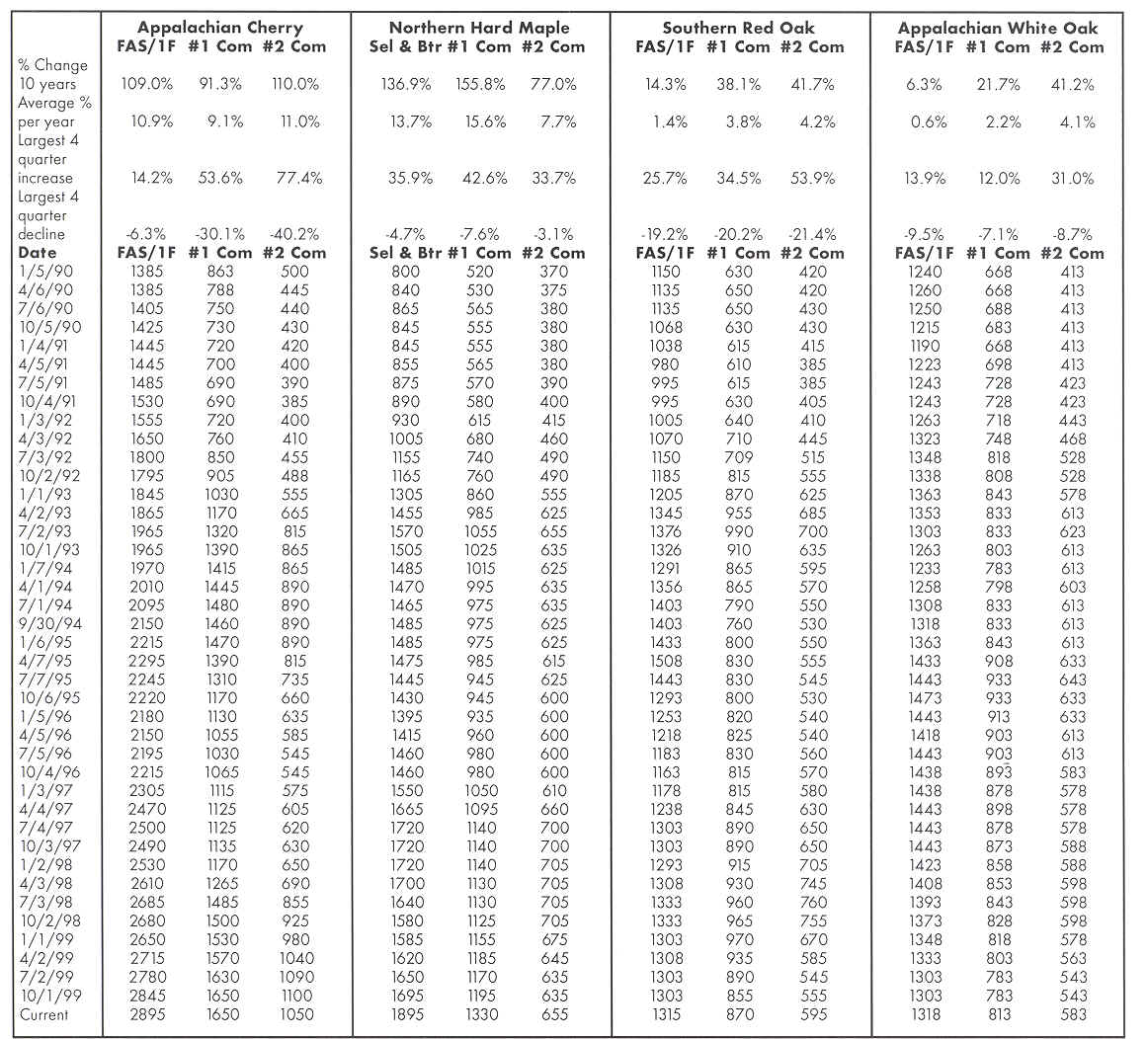

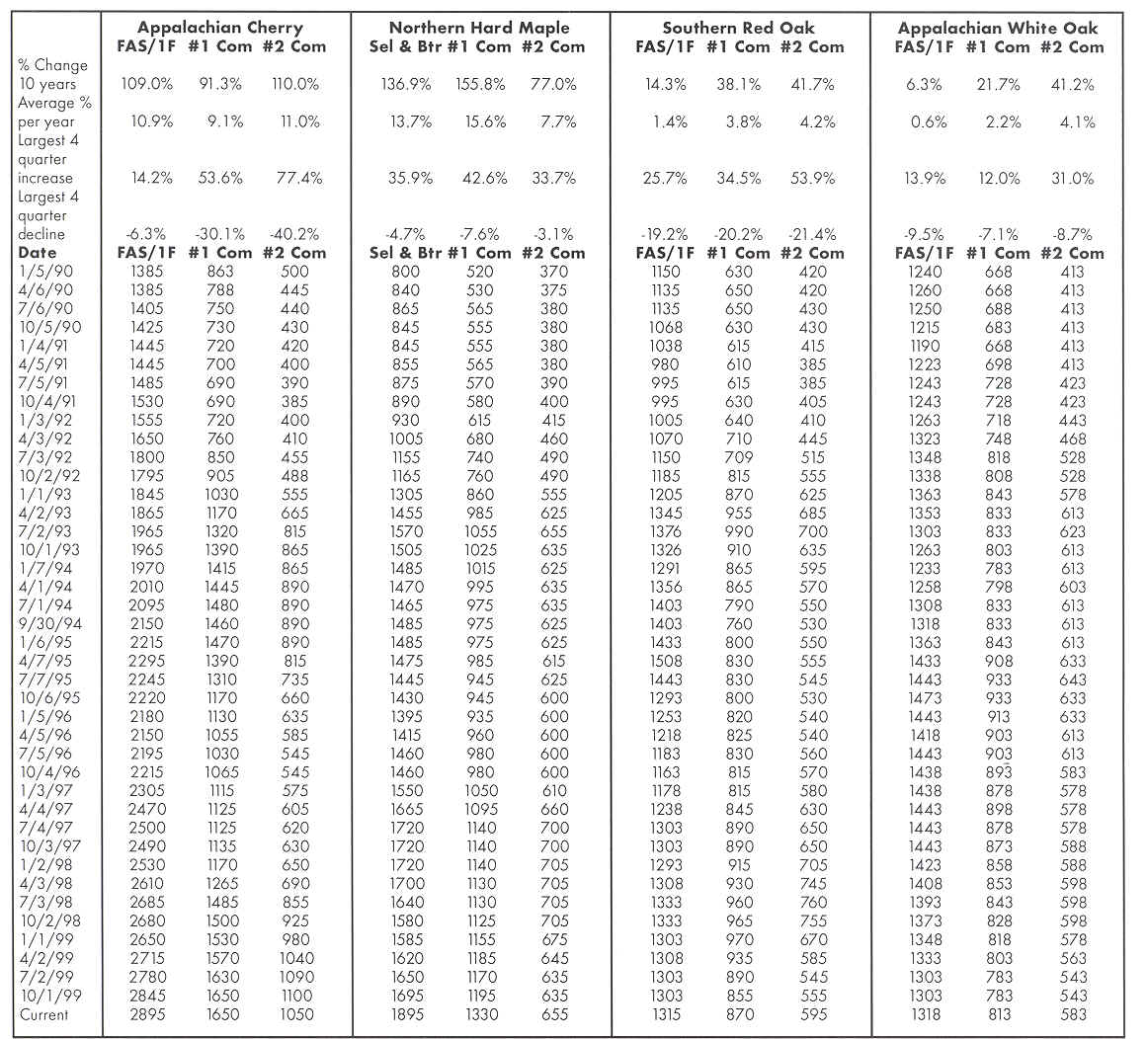

In the table at the right we have included historical price information for Northern

Hard Maple, Southern Red Oak, Appalachian Cherry and Appalachian White Oak by quarters

throughout the 90's. In looking at the information, several interesting points stand out:

- For both Sel/Btr and #1 Common Hard Maple, the number of quarters reflecting price

increases led the number of quarters showing declines by a factor of 2 to 1.

- There have been three distinct "spikes" in Hard Maple prices: April 92-April

93, Oct. 96-Jul. 97, and Jul. 99 - present. In the Apr.92-Apr. 93 upswing, prices

increased 44.8%, 44.9%, and 35.9% for the Sel/Btr, #1 Com, and #2 Com respectively.

- White Oak could certainly be called the species of the first half of the decade. White

Oak FAS/1F prices rose nearly 19% from 1990 to 1995 but have given back over 10% of that

increase since. Likewise, #1 Common increased nearly 40% in the first 5 years of the 90's,

then has fallen back 13% and #2 Common increased over 53%, but has fallen 8% since it

speak.

- Red Oak prices have increased only slightly in the last 10 years. On average 4/4 FAS/1F

Southern Red Oak has only increased 1.4% per year, the #1 Common 3.8% and the #2 Common

4.2%. Prices today for the FAS/1 F are nearly $200mbf below their peak in 1995. From all

reports, timber prices have not dropped, but probably increased during that time.

- Cherry prices have realized huge gains in all grades. FAS/1 F Cherry prices are up 109%

since 1990, #1 Common is up 91 %,and #2 Common is up 110%. The #2 Common price increase is

a huge factor in sawmill profitability as there have been times in recent years that the

#2 Common was not saleable at any price. FAS/1 F Cherry has marched upward consistently

throughout the 90's. Of the 40 quarters, it increased in 29, declined in only 8 and was

steady in 3.

- Cherry has shown several periods of extreme volatility. Many companies who were late

looking at the changes in Cherry got burned, as prices tended to fall just as rapidly as

they increased. Cherry and Hard Maple uppers do not react to market changes as severely as

the #1 and #2 Common grades. When markets change for these species it appears that there

is less risk in hold-ing onto inventory in the upper grades than keeping the com-mons.

Also, because there is little quarter-to-quarter change in Red and White Oak prices, the

risk in carrying uppers in inventory is also less than carrying the common grades.

- Contrary to popular belief, prices have gone up much faster than they have declined. In

looking at the last 10 years, the sustained 4 quarter increases are much larger than the

decreases in the species and grades we examined. The 4 quarter increase/decrease data

illustrates how volatile the #2 common Cherry markets have been, with the 4 quarter

increase running 77.4% while the decrease is running -40.2%. Surprisingly, Southern Red

Oak was also very volatile, with the increase/decrease percentages all running at 20% or

greater.

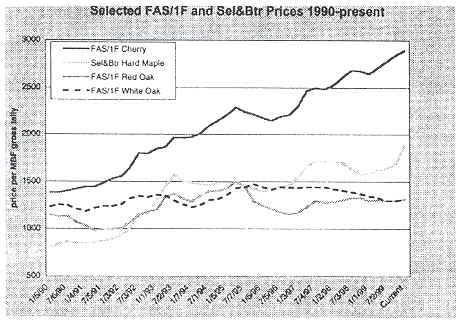

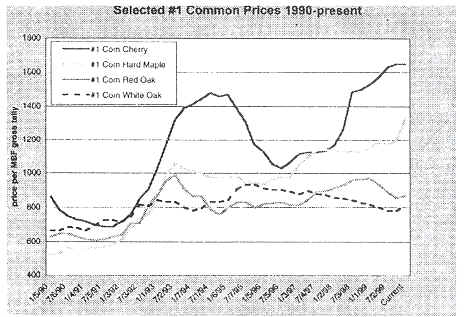

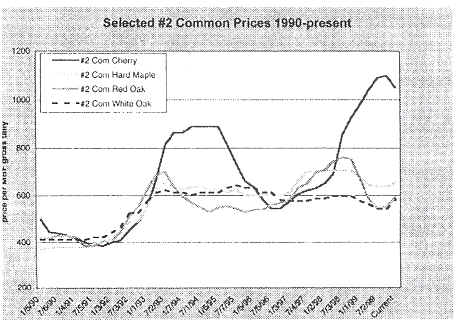

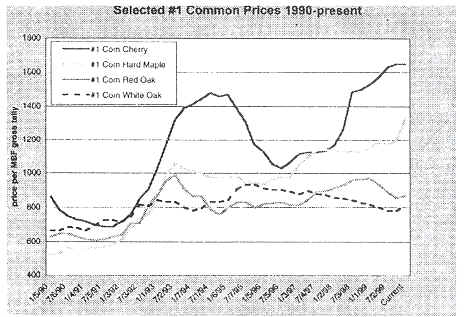

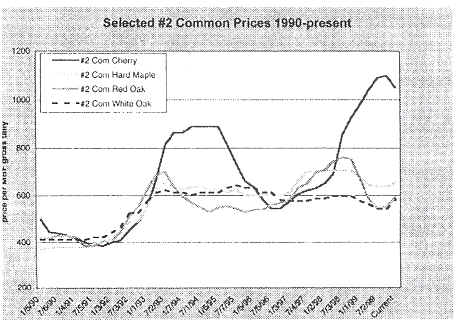

Another interesting way of looking at the data is in comparing the prices for Northern

Hard Maple, Southern Red Oak and Appalachian Cherry and White Oak. Below we have charted

grades against one another for all the selected species.

- Cherry - Note that price range has been trending upward for the decade. Part of the

reason is demand, but lower quality logs, leading to reduced supply has had an impact.

- Hard Maple - The first recovery was in 1993 with a more pronounced upward movement since

1997.

- Red Oak - Except for the rise in 1993/1994 FAS/I F Southern Red Oak has been quite

steady.

- White Oak - Demand for White Oak has been static and as indicated prices have been flat.

- Cherry - Furniture and cabinet demand has pushed use of Cherry to high levels. With

supply limited, Cherry prices have continued to climb.

- Hard Maple - Prices have peaked twice, due to supply and the fact that furniture demand

for Hard Maple is less than Cherry.

- Red Oak - Prices have risen due to more demand for flooring, and also the strong tie and

timber market. The decline in prices is closely related to slower tie demand and inventory

building strategies on the part of flooring plants.

- White Oak - Other than a rise in 1993, White Oak demand has been flat with prices

trending downward.

Weekly Hardwood Review

December 17, 1999, Volume 15, Number 14

Home