Spring 2002 Volume II, Number 1

CHANGES IN PROPERTY TAX SYSTEM AND HOW THEY MIGHT AFFECT YOU

By Jack E. Nelson, Division of Forestry

BACKGROUND:

Some of you may recall the article entitled, "Recent Court decision Impacts Classified Forest &Wildlife Programs" in the1996 summer edition of the Woodland Steward. In that article, I describe how it was determined that Indiana had an unfair property tax system. This system was declared unconstitutional in the court case identified as "Town of St. John (Petitioners) vs. State tax Commissioners (Respondent)". Further, the State had appealed this case up to and including the State Supreme Court. The Supreme Court ruled in favor of the lower court decisions and ordered the State Tax Board to develop a new system based upon real property assessments for purposes of taxation based upon a market value system. Since then, the State Board of Commissioners published a revised manual in September, 1999. Then the governor announced a "Taxpayer Protection Plan" and suspended work on the manual in December, 1999. Following the 2000 legislative session, the petitioner in the St. John's case filed with the Tax Court asking that the reassessment proceed. In May, 2000, the Tax Court ordered the assessment to proceed with a new manual to be published by June, 2001, with an effective reassessment date of March 1st, 2002.

PRESENT:

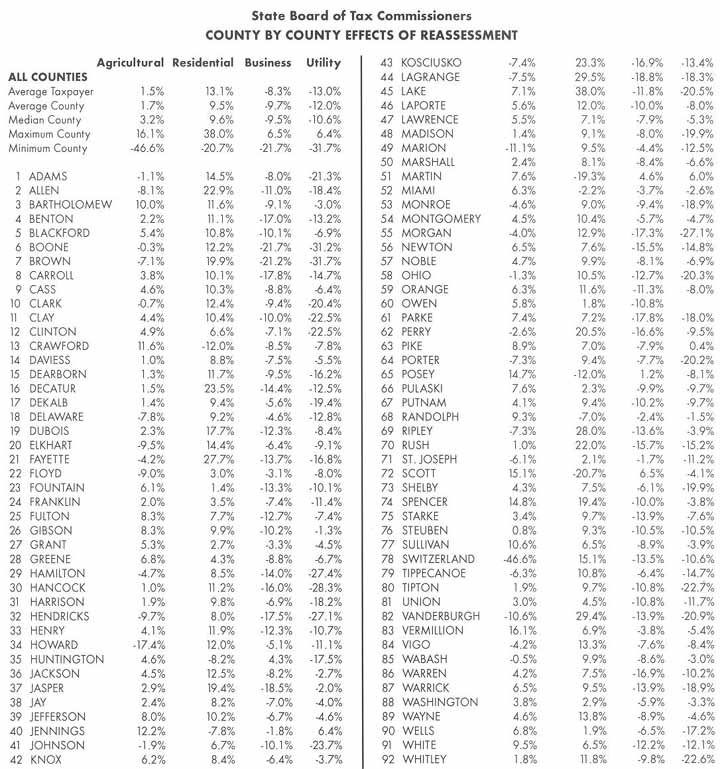

As I write this article it appears that the new property tax assessment will take place beginning March 1st, 2002 with the new taxes payable in 2003. The rest of this article pertains to how this new assessment might effect your property taxes on woodland, classified forest and classified wildlife habitat. No attempt will be made to discuss the effects of the new program on one's residential, agricultural cropland, business, and etc. property taxes. However, at the end of this article there is a listing distributed by the State Board of Tax Commissioners entitled, "County by County Effects of Reassessment". This is the most current information available on what the average increases or decreases in property taxes by county might be based upon "Land Use Types". These types are identified as: Agricultural; Residential; Business & Utility.

In addition, it should be pointed out that the counties and State Tax Commission are still working on tax rates. The mechanism for determining "True Tax Value" or "Assessed Value" (these terms have the same meaning and are used interchangeably) is in place but they still have not published the tax rates. So, currently one cannot go to their county assessor and find out what their property taxes will be for year 2002 payable in 2003.

AGRICULTURAL LAND:

To begin with, all woodland, tillable land, non-tillable land other farmland, agricultural support land, and classified land (Classified Forest & Classified Wildlife Habitat) are classified as Agricultural Land. In the 2002 general reassessment, all Agricultural land has an average market value of $1,050 per acre. This value is based upon the productive capacity of the land, regardless of the land's potential or highest and best use. This is an increase from $495 average market value per acre under the old (3/89) assessment program.

PROPERTY TAX ON WOODLAND:

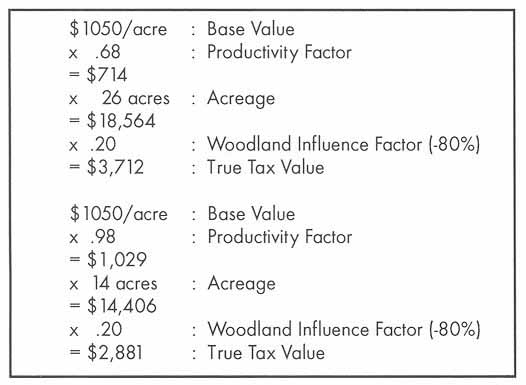

To determine property tax for woodland, the assessor's office takes the "Base Value" of $1050 and multiplies it by the soil "Productivity Factor". All soils are rated based upon soil productivity. The better soils have a higher "Productivity Factor". Then the assessor takes that number and multiplies it by the "Woodland Influence Factor" which is a negative (-)80%. That number then becomes the "Assessed Value" or "True Tax Value". Then the assessor takes that value and multiplies it by the "Tax Rate" to determine the "Taxes Due".

To further explain this process of determining property taxes on "Woodland", I will use the following example. In this example, Mr. Jones owns a 40-acre woodland in Owen county, Indiana. There are no buildings or other improvements on the land. The soil types are identified as average to poor. Twenty six acres has a soil type with a "Productivity Factor" of .68, the remaining 14acres has a soil type with a "Productivity Factor" of .98.The total True Tax Value for the two soil types is $6593($3712 + $2881). Next divide that number by the total acreage of 40 gives a True Tax Value of $165/acre. In this example, if we use a Tax Rate of $3.00/$100 of assessment, the landowner would owe $4.95/acre in taxes($165/ac True Tax Value x $3.00/$100 of assessment). At $4.95 per acre x 40 acres, the woodland owner's property tax would be $198.

The key issue under this new property assessment system is the Tax Rate per $ 1 00 of assessment. Currently, these rates are being established at the county level. In most cases, the rates should be lower than in the post to offset the increase in the Base Value ($1050).

For some landowners, their property taxes will increase, for others they will stay the some or be less,

PROPERTY TAX ON CLASSIFIED FOREST OR CLASSIFIED WILDLIFE HABITAT LANDS:

The Classified land programs allow participating acres to have a fixed Assessed Value or True Tax Value of $1.00 per acre. The county or township Tax Rate is then applied to this$ 1.00 per acre Assessed Value resulting in the taxes due per acre.

Using our 40 acre Owen county example, if this property was in the Classified Forest program, the per acre tax would be $0.03 ($1.00 True Tax Value x $3.00/$100 assessment ) or $1.20 for 40 acres.

MINIMUM $5 BILLING PER PARCEL:

About 10 years ago, the counties set a minimum for all property tax bills. The minimum tax bill the county can send you is$5.00. Therefore, those landowners participating in the Classified Forest program or a similar program will find their tax bill to be $5.00 rather than (as in our Owen county example), a tax bill of $1.20.

PARCEL OR PARCELS:

As a landowner, something you might not be aware of is that the county "taxes" each parcel you own. A "Parcel" by definition is a piece of land with the same ownership (deed or title). Therefore in the Owen county Classified Forest example, if you purchase the 40 acre woods in two - 20 acre parcels with separate title (deed), the county would consider it as two parcels totaling 40 acres. As such, the county would send you two tax bills for $5.00 each or $10 total. Under Indiana Code 6-1.1-5-16 you can petition the county assessor or township assessor to consolidate those adjoining parcels into one parcel for tax reasons. There are restrictions, but it's worth checking it out.

WHAT'S AHEAD FOR THIS NEW ASSESSMENT:

In a recent news article, a leading economist working on the new property tax assessment, said that once the program is up and running, it should be easier for property owners to understand how their taxes are levied. But, he cautioned, it could take years to perfect the new system and several reassessments to really get it right. As with any new system, it will be a learning experience for the county assessors, legislators, and property owners. As a property owner, you need to stay on top of these changes and how they affect you. Learn to understand your property tax bill. Ask questions! No doubt, mistakes will occur! And if they do, challenge the assessor's office for an explanation. But be kind, remember, this is a new system to them.