Summer 2002 Volume II, Number 2

INDIANAíS CONSULTING FORESTERíS STUMPAGE TIMBER PRICE REPORT

By John Siefert, Purdue University

This stumpage price report is provided on a semi-annual basis and should be used in association with the Indiana Forest Products Price Report and Trend Analysis written by Dr. William Hoover in cooperation with Indiana forest product companies. Dr. Hoover's report will be published in the next issue of the newsletter.

Stumpage price data was obtained by a mail survey to all known professional consulting foresters operating in Indiana. Reported prices are for sealed bid timber sales only, (not negotiated sales) between a motivated timber seller and a licensed Indiana timber buyer. The data represents approximately 10 to 15 percent of the total volume of stumpage purchased from August 15, 2001 to February 15, 2002 period. '/

The results of this stumpage price survey are not meant as a guarantee that amounts offered for your timber will reflect the range in prices reported in this survey. The results simply provide an additional source of information to gauge market conditions.

The sealed bid timber sale process is for trees marked by a professional forester. The species, number of trees and volume in a sealed bid sale are determined prior to the notice of sale. A notice is sent to licensed timber buyers who then offer a price for said trees at a predetermined time and place. Under conditions deter-mined in the bid notice, the owner then accepts or rejects the bids. Upon acceptance of the bids by the owner and fee paid, the owner then conveys the right to cut the advertised trees to the purchaser. This is frequently referred to as a lump sum sale.

This report reflects "spot market" prices, not the average price paid by timber buyers. The bidding process used by consultants "spots" the maximum amount any buyer is willing to pay for a particular lot of timber at a particular time and place, not the average price paid for timber. High bids frequently reflect an urgent need for timber because of special orders for lumber or veneer, low log inventories at the buyer's mill, poor logging conditions due to wet weather, or other special conditions.

Hardwood lumber is sold in a highly competitive commodity market. Competition comes from mills within the state, region, and hardwood lumber producers in the Lake States, Northeast, South, and Southeastern production areas. This market competition means that the cost of stumpage in other producing regions determines in part the amount Indiana mills and loggers can pay for stumpage. If all timber were sold on a bid basis the spot market would no longer exist and the average of the highest bid price offered would be lower than now observed. This explanation isn't meant to deter you from seeking the best available price.

Sealed Bid Prices

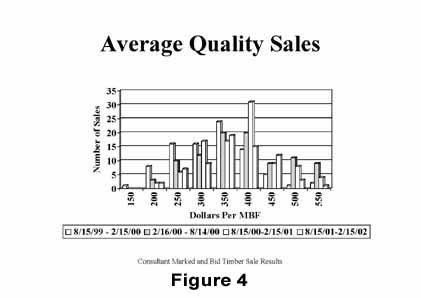

The prices reported are broken into three sale types: high

quality, average quality and low quality. A high quality sale is one where more

than 50 percent of the volume is number 2 or better grade red Oak, white oak,

sugar maple, white ash, black cherry, or black walnut. The average sale is

considered one that is not a low or high quality sale. The low quality sale has

more than 70 percent of the volume in number 3 grade or is cottonwood, beech,

hickory, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust,

honey locust, catalpa or sweet gum.

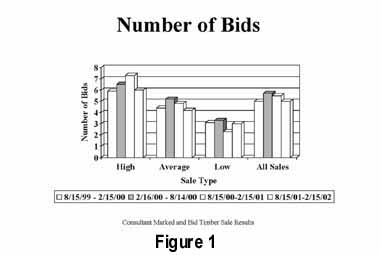

A total of 188 sales were reported for this six-month

period. Figure 1 shows the number of sealed bids offered by sale type. A total

of 944 bids were received for the 188 sales. The figure also reflects what

foresters have been suggesting, higher quality timber offered for sale increases

buyer interest and the number of bids offered. High quality timber sales for the

fourth consecutive reporting period showed increased number of bids over the

average and low quality sales, while average and low quality sales have shown a

general decline in the number of bids received. The average number of bids

offered for all sales was 5.1 for this period. Twenty-six sales were completed

by negotiation after the seller rejected all initial bids. This is a significant

increase over the last repor ting period indicating sellers expectations of

higher prices in a softening timber market.

ting period indicating sellers expectations of

higher prices in a softening timber market.

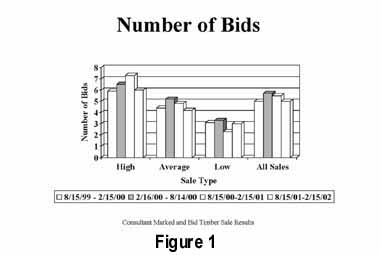

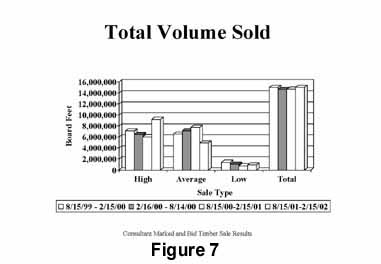

A total Doyle stumpage volume of 14,398,544 was sold during this period Figure 2. The average volume per sale was 85,753 bd. ft. for high quality, 69,761 bd. ft. for average quality and 63,255bd. ft. for low quality. Value by sale is reported in Figure 3. Total timber value sold was $6,774,701.00. Average sale value by type was $47,143,$25,753 and $12,896 respectively.

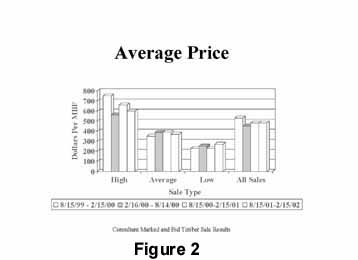

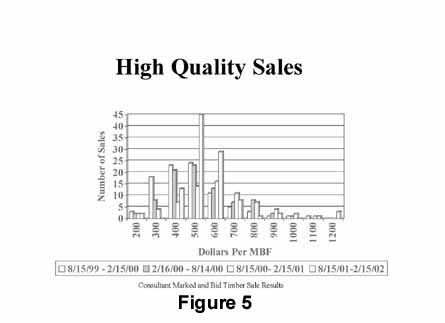

Average price by sale type is reported in Figure 4. Average price slipped for both high and average quality sales, with the low quality sales holding about the same from the previous report. The price reported is per 1000 board feet (MBF) of standing timber. To obtain a price per board foot, divide the price by 1000. An aver-age price of $502.00 per thousand (MBF) is also the same as 50.2cents per board foot. The average price reported for all sales and types remained steady at 48.0 cents per board foot stumpage from the last reporting period. Price ranges by sale type are report-ed in Figures 5-7. Also below is the statistical summary for all three-sale types.

The comment section following is offered to our readers by the consulting foresters who participated in this survey. Although the price of lumber and logs has been down, sales of stumpage - standing timber has been as strong as ever. The most favored species include good oak, sugar maple, cherry and walnut. Poplar is holding with hickory showing some interest from buyers. Recently sold white oak veneer trees were shipped to Italy.

Interest and prices for stumpage have remained good throughout the winter. I think that the reduced availability of standing timber has kept the number of bidders and stumpage prices at a fairly high level.

Small red and black oak are bringing good prices for rotary

veneer for laminated flooring. Market outlook seems to be better than 6 months

ago. Some mills are in trouble after paying too much for standing timber before

the slow down in the economy.

While the market report shows a decline, the price paid for stumpage is amazingly high in south-central Indiana. Sugar maple and cherry top the list as to what is selling the best, with red and black oak doing well with strong demand. White ash and white oak is fair to good depending on the timing of the sale. Consider the stumpage price for standing timber to be great and will continue to do so for the rest of the year.

White oak sawlogs remain weak, black walnut, sugar maple and cherry strong, poplar has improved over the last 6months, white oak veneer logs and red oak sawlogs in high demand, with small diameter and low grade suppressed.

Lumber market is slow, yet sales seem to be doing very

well. Red oak is moving very well! Pallet grade species still in demand, but no

change in prices. Quality white ash is still a disappointment. Large volume,

high quality bur oak, black cherry, sugar maple, black walnut are drawing a lot

of attention.

Bidding on marked sales has been conservative due to uncertain markets, but still are selling for appraised value or more. Expect the lumber market to remain tight as we test exports and factor in foreign imports. The hardwood market reports show reduced output and steady prices.

Timber market for several species is hard to determine at present time. Next price report will reflect a more accurate accounting of what is going on in the market. Black walnut is selling very good - best in years. Ash market is flat and probably will be for quite a while.

Stumpage prices held strong despite concerns with the

national economy. Number of bidders actually increased during this period.

Walnut and cherry remained in high demand, while tulip and ash demand weakened.

Markets during this reporting period were fair. Things slowed down a bit since lost summer. Good quality timber continues to sell at expected prices. Lower quality is having trouble moving at all. Walnut cherry, hard maple and red oak are all still in good demand.

(All comments ore provided by participating consulting foresters. They do not represent the opinions of the Woodland Steward Institute or the Woodland Steward Newsletter.)

The following list of consulting foresters has provided the data and comments for this article.

ABC Forest Management - Brian Cruser, ACF

Akard Forestry Consultants - Jim &Julie Akard, ACFChris Egolf

Forest Management Services - Larry Owen, ACFForest & Wildlife Services - Don Reed Frank Gottbrash

Gregg Forest Services - Mike Gregg

Houbry Forestry Consultants - Rob Houbry Norman LaMunion

Meisberger Woodland Management - Don Meisberger, ACF Moser Woodland Services - Randy Moser

Multi-Resource Management, Inc. - Fred Hadley,

ACFNorth Slope Silvics - Don Duncan

Stambaugh Forestry -John Stambaugh

Turner Forestry - Stewart Turner

Wakeland Forestry Consultants - Bruce Wakeland, ACFO

'/ This estimate was based on an annual harvest of 353 million board feet of sawlogs in 1995 and an unpublished survey of sealed bid timber sales by professional foresters. Source: Indiana's Timber Industry - An Assessment of Timber Product Output and Use, 1995. Resource Bulletin NC- 193 haves U.S. Forest Service.