2022 Indiana Consulting Foresters Stumpage Timber Price Report

This report is provided annually and is intended to be used as a general indicator of timber stumpage prices and activity in Indiana. There are many factors that determine the price of any individual timber sale, including tree species and quality, average tree volume, size of sale, ease of operability, access and yarding issues, proximity to markets, region of the state, availability of other timber in the area, number of bidders interested in the sale, season it can be logged, economic forecasts and many more. For this reason, the reported prices should not be considered as a guarantee of the value for any given sale. However, this report can be used as a general trend of timber sale prices and where the range would be for most sales meeting the same criteria. To best market your timber, it is recommended you contact a consultant forester that can gauge your timber value in your area and markets.

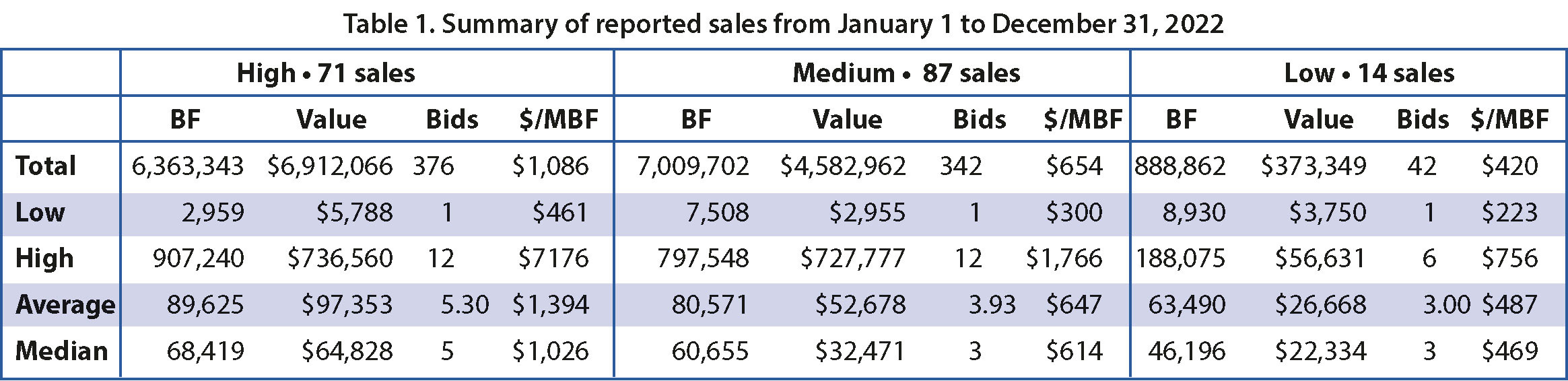

To create the report a survey was made of all known professional consulting foresters in Indiana. Sales were reported from all areas of the state. Prices were reported from sealed bid timber sales (not negotiated sales) between a motivated seller and a licensed Indiana timber buyer. The data represents sales from January 1 to December 31, 2022. This survey has been conducted annually since 2001.

Timber Sale Price Survey

Timber sale categories: As in the past, sales were reported in three categories based on quality. A high-quality sale has more than 50 percent of the volume in #2 or better red oak, white oak, sugar maple, black cherry, black walnut or soft maple. A low-quality sale has more than 70 percent of the volume in #3 grade (low or pallet grade) or is cottonwood, beech, elm, sycamore, hackberry, pin oak, aspen, black gum, black locust, honeylocust, catalpa, sweetgum or pine. An average sale is a sale that is neither a high- or low-quality sale.

Survey responses: There were 15 consultants that reported prices this year. This is a decrease from the 20 that reported last year but in the range of the 15 to 20 that have reported each year since 2015. Prices were reported from 172 sales which is a decline from the 270 sales reported last year and the annual average since 2014 of 280. Reported sale volumes also declined steeply from 25,049,006 board feet in 2021 to 14,261,907 board feet. The average reported sale volumes have averaged 24,825,060 board feet since 2015. Total sale values, over all three categories, also decreased from last years $20,754,187 to $12,057,263.

High quality sales: There were a total of 71 sales reported by 11 respondents in this category. Sale volumes ranged from a low of 2,959 board feet to a high of 907,240 board feet. The average high quality sale was 89,625 board feet per sale. The median volume was 68,419 board feet. Overall, the weighted average of these sales was $1,086/MBF (thousand board feet). This price is down from last year’s historical high of $1,164 by about 7%. It is important to note that prices for high value species such as walnut and white oak, both veneer and lumber, can cause a wide range of prices between sales depending on the volume and quality of these species in a specific sale. Therefore, the range within this group went from a low of $492 to a high of $7,176/MBF.

Medium quality sales: Fourteen consultants reported 87 sales in this category. Sale volumes ranged from 7,508 board feet to 797,548 board feet and averaged 80,571 board feet per sale. The median sale volume was 60,655 board feet. These sales averaged $654/MBF, which was nearly identical to last years $652. The range of prices by sale went from a low of $300 to a high of $1,766/MBF.

Low quality sales: Only 7 consultants reported 14 low quality sales. Sale volumes ranged from a low of 8,930 board feet to a high of 188,075 board feet. The average sale was 63,490 board feet and the median volume was 46,196 board feet. The sale prices ranged from a low of $223/MBF to a high of $756 and averaged $420, an increase from last year’s $377/MBF.

Survey Response Discussion

Volume of timber sold: Since the survey only catches a voluntary sampling of the timber sales occurring across the state, the number of reported sales cannot be definitively used to indicate an increase or decrease in the total number or volume of timber sold. However, many consultants indicated a decrease in the number of sales they had in the second half of the year due to uncertainty of the markets and an increase in other jobs, such as invasive control and TSI. The general feeling is that landowners and foresters are being more selective in the sales they are offering due to the markets.

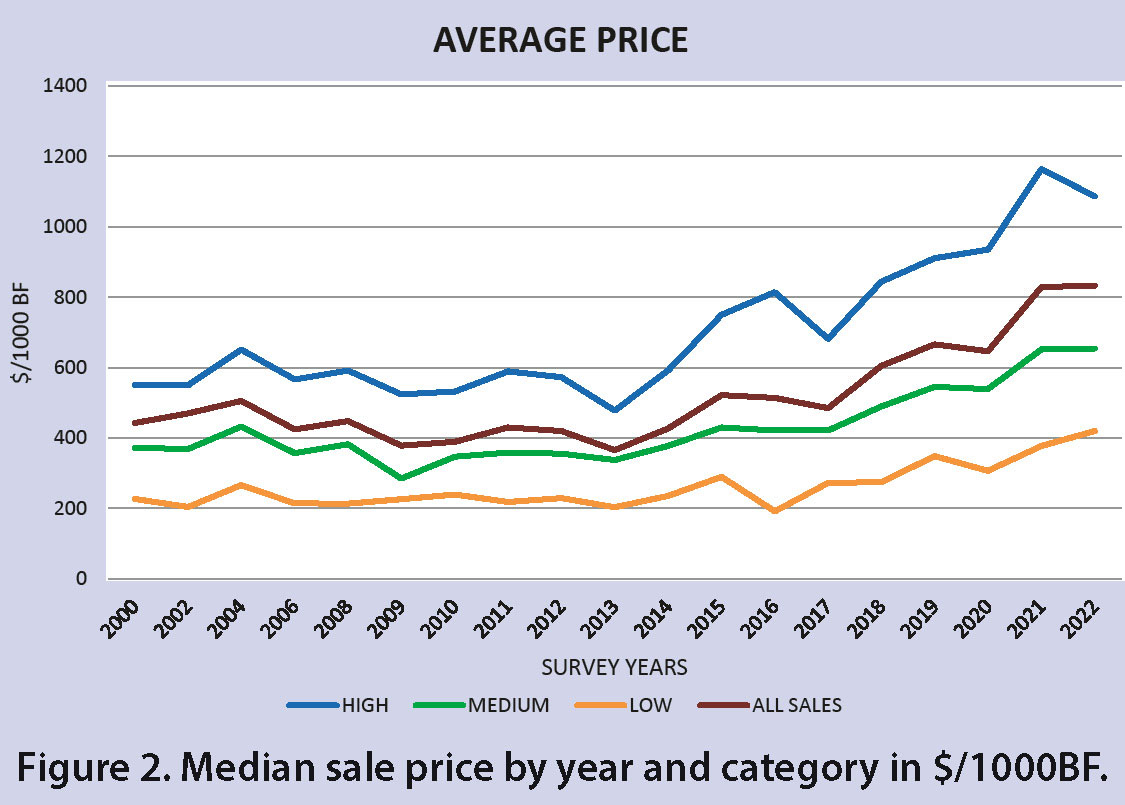

Value of timber sold: For perspective, timber prices in 2021 were at historically high levels as demand outpaced supply for nearly all species and grades. In fact, these prices were so out of the ordinary that some have viewed it as a “bubble” or “crazy high”. Nice while it lasted but bound to burst. When looking at the value of timber prices for all of 2022, all three quality levels continued to stay strong. For instance, the high quality sales in 2022 averaged $1,086/MBF, compared to the 2021 average price of $1,164/MBF. Medium quality sales in 2022 averaged $654/MBF compared to $652 in 2021. And the low quality sales increased to $420/MBF from the $377 in 2021. However, it is hard to look at 2022 as a whole and not in the context of the first 6 months and the second 6 months. For the high quality sales conducted January to the end of June, they averaged $1,256/MBF, 8% above the 2021 prices. In comparison, the sales in July to the end of December averaged $831/MBF, a steep decrease. This pattern is consistent with the other quality levels as the medium sales averaged $697/MBF in the first 6 months compared to $581 in the second 6 months and the low quality sales were $472/MBF in the first half of the year and $334 in the second half. But here is the perspective. Those second half numbers are still strong historically. The high quality second half prices are higher than any prices in the history of this report prior to 2018. The medium quality second half prices were the highest ever before 2021. And the second half low quality prices were higher than any prices reported for that category before 2019. See Figure 1 for the annual prices.

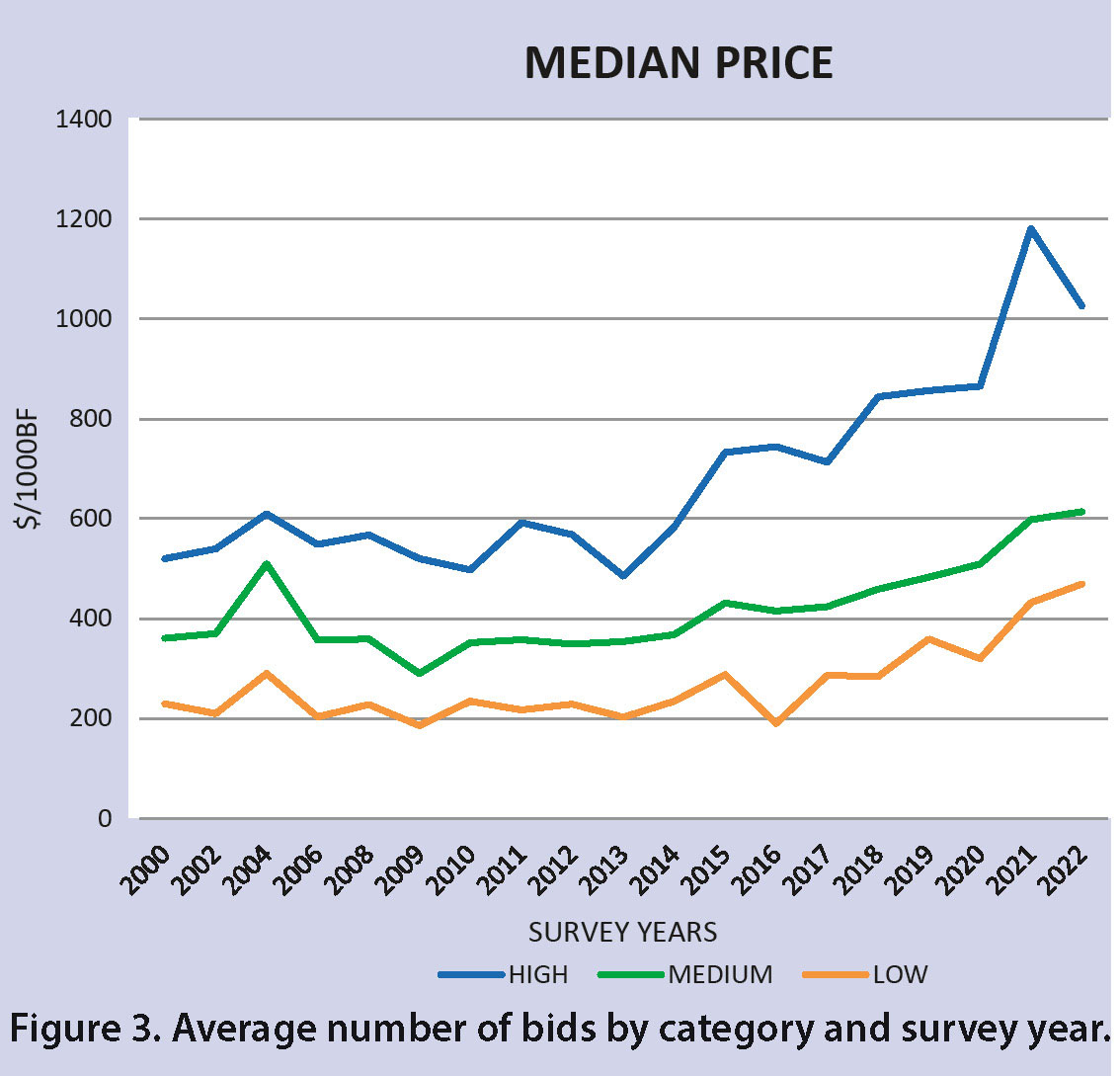

Median values: In contrast to averages, which can be skewed by extremely low or high values, median values are often a better indicator of timber value trends. The median values also indicate strong prices from a historical perspective. For high quality sales the 2022 median price of $1,026/MBF was less than the average price of $1,086. It was less than the 2021 median price of $1,180/MBF but far exceeded the previous high of $865 set in 2020. The medium quality sales in 2022 had a median of $614/MBF which was an increase of nearly 3% from the previous high of $598 set in 2021. The low quality sales median in 2022 was $469/MBF as compared to the average of $420. The median far exceeded the previous high of $432 set in 2021. See Figure 2 for median prices.

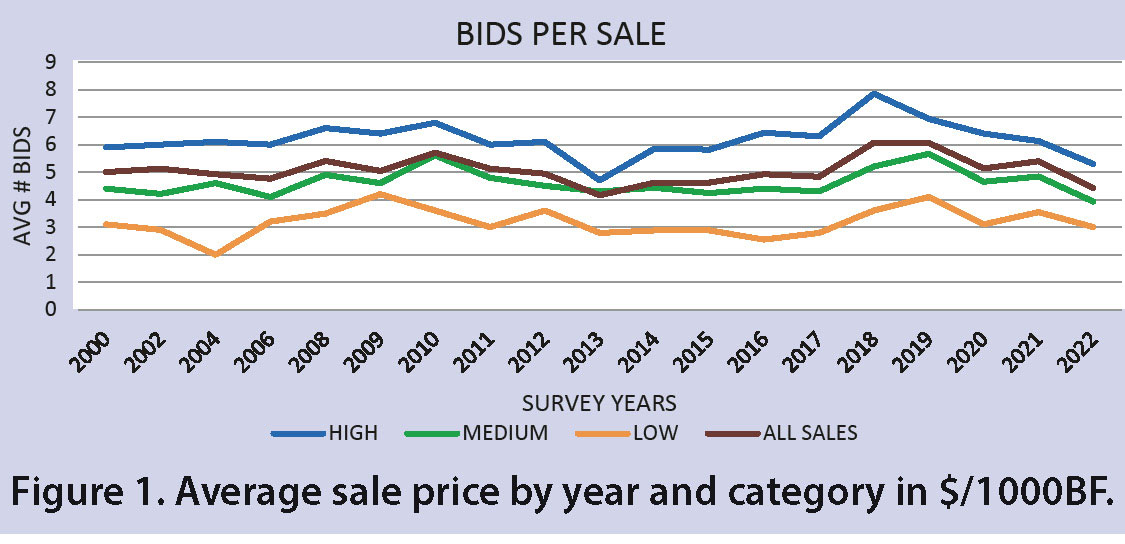

Sale bids: Across all of the sale categories there were a total of 760 bids received for the 172 timber sales. This is an average of 4.42 bids per sale. This is the lowest overall average since 2013. For high quality sales the average number of bidders was 5.30. This is a steep decline from the average last year of 6.13 and the historical average of 6.24. The 5.30 bidders is the lowest average for high quality sales since 4.70 in 2013. For medium quality sales this year’s average was 3.93 bids/sale. This was also a significant decline from the record high 4.84 from last year and is in fact, the lowest since the survey began in 2000, falling short of the previous low 4.1 in 2006. The average bids for medium quality sales since 2000 is 4.61 bids/sale. Finally, for the low quality sales the average number of bidders in 2022 was 3.00. This is lower than the 3.55 from last year and the lowest since the 2.80 in 2017. The average since 2000 for low quality sales is 3.18 bids/sale. See Figure 3 for bids per sale.

Conclusions: The number of surveys received for the year 2022 was a decrease from last year, both in number of respondents and the number of sales reported. This may or may not indicate a reduction in timber sales across the state but comments made indicate it is a reduction of sales administered by some consultant foresters. There are a number of reasons, including workload in other types of work conducted by consultants, but the cooling of timber prices did seem to slow down sales in the second half of the year. However, the survey shows that timber prices continued to surge in the first half of the year, surpassing even the record 2021 year across all qualities of sale. When prices did cool off in the second half of the year, they continued to be strong from a historical perspective.

Consultant Comments and Other Thoughts

Note: These comments are the opinions of individuals from different parts of the State and with different markets. They may or may not be relevant to your situation. You should always discuss timber marking and marketing with your consultant to get the best information relating to your timber management.

• It appears the extremely high timber prices of 2021 and into 2022 have passed and expectations going forward should be tempered somewhat. Doesn’t mean the markets are bad, they just aren’t breaking records anymore.

• Markets were especially high in the first half of the year with some of the best white oak and black walnut prices we have ever seen. Second half the markets have cooled but still good prices. Good timber is still in demand but some of the marginal timber might receive a bit less interest.

• Prices and interest seemed to slow down throughout most of the year except for white oak. Even walnut interest declined with fewer bids from the normal walnut buyers who said they were struggling to get orders for green walnut lumber. Most have said that the veneer prices were still good however.

• Pallet mills have a good supply at the end of the year so they are not as aggressive as earlier in the year.

• I had one white oak sale in November that went very well and they cut it right away for fear the markets might start dropping for white oak. The sale had 12 bidders which is much more than normal. We normally average 3-5 bids on decent sales.

• A buyer mentioned that they are not carrying much standing inventory because of the fear of prices dropping even further.

• We put up fewer sales this fall than normal because of the dropping prices and less interest from buyers.

• It was one of our lowest selling years for timber. Our tree planting and brush control has grown to over half our business now. These two services have pushed down our TSI and timber sale numbers. With projected numbers for future Farm Bill work I don’t see that changing without an increase in staffing.

• The interest rate hikes coordinate almost perfectly with the downward spiral in the lumber market spot prices in the second half of the year. On the stump, this meant a lot of uncertainty but fairly resilient pricing yet. I always find it fascinating that stumpage prices are very slow to drop on forester sales, but in private sales I am sure they dropped more.

• I held back on some sales in the fall, unsure if I should proceed. We had some sales in December that went well enough that I’m inclined to keep selling timber. What I am considering is cutting back on how many trees I sell of certain species that have taken the biggest price hits, like red oak. This may mean slightly lighter harvests until the markets stabilize.

• The lumber industry seems to have made its corrections fairly quickly, so I think we will hit equilibrium again in the first quarter of 2023 on the supply/demand side.

• Of all the markets, the typically strong northern Indiana pallet grade market was the most resilient, but that domino is likely to fall soon too. If yards fill up and people buy enough timber contracts, we’ll more likely to see fewer or no bids, rather than lower prices on the stump.

• If the Fed is going to keep raising interest rates and cause an actual recession…all bets are off but it won’t be as bad as 2008-12 for sure. So far, I think stumpage pricing is staying fairly firm at a slightly lower level with potential to creep back up a bit, but the crazy high price days are over. I think the housing market has yet to see its full correction, but that is probably around the corner so there are still headwinds to navigate.

• The white oak market continues to be driven by the stave market (whiskey barrels). Large white oak especially brings higher values even if they are not high-quality trees.

• In southern Indiana large quantities of pine are being sold as there are several different markets available.

• Good stuff almost always sells well but it doesn’t mean you should sell it.

• Access and contract terms are important to timber value. Financing flexibility and ease of operations can add thousands of dollars to your sale value.

• Sealed bid sales on marked and tallied timber offered to a wide range of buyers is the only way to make sure you get the best price for your timber on any given day.

• Good or bad timber prices should not be used as an excuse for poor forest management. Planning, waiting for trees to be ready, controlling invasive species and timber stand improvement is still important for the long-term health and productivity of forests and will pay off in the long term.

Some timber buyer comments:

• It seems that consultants aren’t putting much timber out there which is causing good interest in current sales and even though the lumber markets are contracting, bidders are putting good money on available material at current pricing guidelines.

• We have to run our mill in good times and bad. Loggers need to work no matter what the market conditions warrant.

• I am concerned we will lose more loggers available to harvest timber through these turbulent times.

• The hardest thing to endure is unstable markets. The market took a moon shot into historical pricing and now collapsing back into something normal. I think the pricing might dip down below normal and hopefully levitate and settle down into stability. It is so difficult to create a business plan even 6 months down the road not knowing where the market will be at the time of harvest.

• I have never seen such market volatility in my 40+ years in this industry and I’ve never seen the market declines this long and at this time of year. Generally, you see market stability in early fall through winter. Not this year.

• With the Fed increasing interest rates along with this run-away inflation causing the housing markets to cool, I think it will continue to create problems for our industry. Too many unknowns that have to play out.

Professional Consulting Foresters responding to this survey in alphabetical order: Arbor Terra (Mike Warner and Jennifer Boyle Warner), Bear Forestry (Abraham Bear), Cox Forestry Consultants, LLC (David Cox), Creation Conservation, LLC (Brian Gandy), Chris Egolf, Ernst Forestry (Dan Ernst), Gregg Forest Services (Mike Gregg), Habitat Solutions (Dan McGuckin), Haubry Forestry Consulting, Inc, (Rob Haubry), Meisberger Forestry, LLC (Matt Meisberger), Multi-Resource Management, Inc. (Doug Brown and Anthony Mercer), Rooted In Forestry, LLC (Mike Denham and Andrew Suseland), Stambaugh Forestry (John Stambaugh), Steinkraus Forest Management (Jeff Steinkraus) and Woodland Works (Nate Kachnavage).